Serra Verde Group (“Serra Verde” or “the Company”), the only large-scale producer of critical heavy rare earths (“HREEs”) outside of Asia, is pleased to announce it has agreed a US$565m financing package (“the Financing”) with the US International Development Finance Corporation (“DFC”), including an option for the US Government to acquire a minority equity stake in Serra Verde.

The Financing confirms Serra Verde’s unique strategic leadership position in the global rare earth industry, due to its HREE-rich product mix, advanced production status, compelling economic profile, and track record as a responsible operator with growth options extending beyond 20 years. As proven pioneers in non-Asian HREE production, the Company is uniquely positioned to support a diverse range of industries which are essential to economic and national security interests.

Serra Verde’s product contains a high proportion of the HREEs dysprosium and terbium and other critical heavy rare earth elements that are essential for high tech components used in the automotive, medical, renewable energy, electronics, robotics, defence and aerospace industries.

The Financing will be used to refinance existing loan facilities at more favourable terms and, crucially, further optimize Serra Verde’s Brazilian operations by expanding capacity, enabling a sustained lower operating cost profile and enhancing its product for new markets.

The fully funded project to optimize Serra Verde’s operations is on budget and ahead of schedule with the Company well on track to deliver an expansion of production to 6,500 tonnes of Total Rare Earth Oxide (“TREO”) by the end of 2027.

The increased competitiveness and resilience of the Company will underpin supply security and future growth for critical industries downstream. This is in line with the Company’s aim to enable the creation of new technologies dependent on REEs that can secure the future of our planet and improve the lives of subsequent generations.

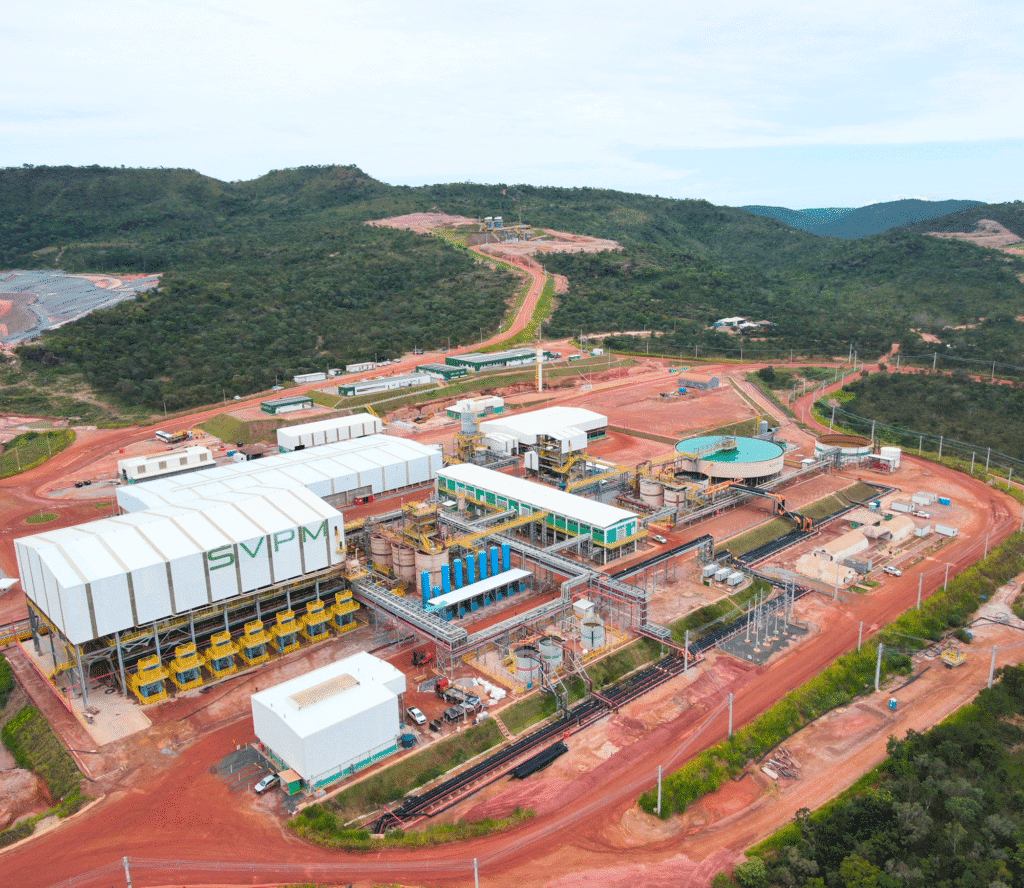

Serra Verde already benefits from attractive operating conditions and strong sustainability credentials due to the location of its operation in an established mining and processing jurisdiction in Brazil, which provides access to renewable electricity, high quality infrastructure, a skilled local workforce and knowledgeable communities. Furthermore, the operation benefits from the advantageous geology of a very large, soft and near-surface ionic clay HREE deposit and low impact operations. As an integrated operator, both mining and processing these elements, the Company produces and sells a high quality Mixed Rare Earth Carbonate (“MREC”).

Thras Moraitis, CEO of Serra Verde, said:

“Throughout Serra Verde’s 15-year journey, the Company has been diligently focused on growing a responsible, sustainable supply of critical rare earth materials for the world’s future needs. Today’s visionary support by the US Government will directly accelerate our development and demonstrate to other investors and our downstream customers the opportunity to support a mission for a better tomorrow.”

Ricardo Grossi, President of Serra Verde Pesquisa e Mineração and COO of the Serra Verde Group, said:

“We are grateful for the US Government’s support of our operation, which is a significant endorsement of what has been achieved over more than 15 years by our operating team in Brazil. I commend the significant contribution of our skilled workforce, our community in Minaçu and the efforts of Municipal, State and Federal governments in Brazil.”

Ends

Contacts

Aura Financial

Email: serraverde@aura-financial.com

Tel: +44 20 7321 0000

Michael Oke / Andy Mills

Notes to Editors

About Serra Verde

Serra Verde’s operation benefits from a large, long-life deposit containing an elevated proportion of high value heavy and light REEs, primarily neodymium (Nd), praseodymium (Pr), terbium (Tb) and dysprosium (Dy) that are key to permanent magnet production as well as applications in the defence, nuclear, aerospace and other critical industries.

This makes Serra Verde a strategic asset within the emergent global magnet-producing value chains. Commercial production commenced in early 2024 and operations are currently being optimized through the expansion of capacity, enabling a sustained lower operating cost profile and enhancing its product for new markets. Serra Verde is assessing the potential for a Phase II expansion which could double run-of-mine production before 2030.

The operation is located in an established mining area in central Brazil in the state of Goiás, with access to a skilled workforce from the nearby town of Minaçu and close to existing transport, renewable power, water and other infrastructure.

Serra Verde is the largest known ionic-clay REE operation outside of Asia. Ionic clays can be mined with low-cost open pit mining techniques and processed using simple, low energy and environmentally benign technologies and reagents. As a result, its environmental impacts are lower than at other rare earth operations. Serra Verde is fully permitted and is producing and selling a valuable Mixed Rare Earth Carbonate (MREC).

Forward-Looking Statements

This release contains forward-looking statements. Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “forecast,” “guidance,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the completion of construction of Phase I of the Pela Ema deposit, expected benefits of REEs, production, financial position and business strategy.

Forward-looking statements are based on current expectations and assumptions and analyses made by Serra Verde and its management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to the ability to complete construction of Phase I of the Pela Ema deposit on time and within budget, the success of production and the market for and prices of REEs. Serra Verde undertakes no obligation to revise or update publicly any forward-looking statements except as required by law.